DK Business Network

Indiqube Spaces Limited successfully raised ₹700 crore initial public offering, which included a fresh issue of ₹650 crore and an Offer for Sale of ₹50 crore by Promoter Selling Shareholders. The company issued over 29.5 million equity shares during the IPO.

- The retail category was subscribed 12.90 times

- Qualified Institutional Buyers (QIBs) subscribed 14.35 times

- The Non-Institutional Investor (NII) category saw 8.27 times subscription

This overwhelming demand highlights investor confidence in Indiqube’s business model and market outlook.

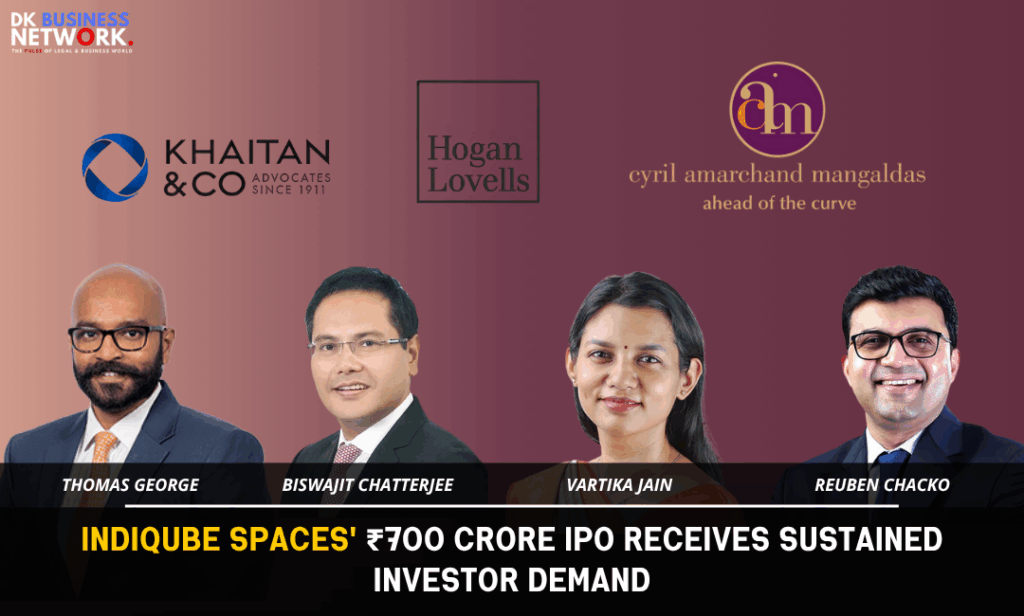

Legal Advisors to the Transaction

Khaitan & Co represented Indiqube Spaces and the Selling Shareholders of the Promoter. Thomas George was assisted by Prathiksha Panduranga, Jash Botadra, Lakshmi Raj C, Rupa Veena S, and Pooja Agarwal. Cyril Amarchand Mangaldas represented the book running lead managers, ICICI Securities and JM Financial. CAM was led by Reuben Chacko and Vartika Jain, with assistance from Dhruv Sharma, Akhil Sreenadhu, and Zubin Ronnie.

Hogan Lovells served as international counsel to the BRLMs. The international team was led by Biswajit Chatterjee, with assistance from Varun Jetly, Kaustubh George, Suchisubhra Sarkar, Aditya Rajput, Aditya Dsouza, Sanjana Ravjiani, Komal Israni, and Purva Mishra.

IPO Proceeds to Support Business Expansion

Indiqube Spaces is a leading provider of technology-enabled and sustainable managed workspace solutions. The IPO proceeds will be used for business expansion, aimed at strengthening the company’s position in India’s commercial real estate sector.

Instagram: Click Here

LinkedIn: Click Here

For Collaboration and Business: dkbusinessnetwork@gmail.com